原创 安信金属齐丁团队 来源:齐丁有色研究

美东时间3月15日17:00(北京时间3月16日凌晨5:00),美联储继3月3日紧急降息50bp之后,再次紧急降息100bp到0-0.25%,并且开启7000亿美元量化宽松(至少5000亿美元国债+至少2000亿美元MBS)。

另外,下调美联储紧急贷款贴现率125bp至0.25%,银行可以从贴现窗口借款长达90天,并将存款准备金利率降至零。美联储还与其他主要央行将常备美元流动性互换安排利率下调了25个基点。

我们认为,美联储再次没有等到3月18-19日的例行FOMC会议而做出宽松决策,降息到0并开启QE,可以说已经把鸽派态度表现的淋漓尽致。但是,如此急迫的再次宽松,由于当前疫情加速蔓延带来的通缩预期还没有逆转,所以市场反应平淡,反而会预期决策层如此急于宽松,可能看到了更糟糕的事情。

回顾历史,2008年11月25日美国推出QE1时由于金融危机还在恶化,当时市场反应也是相对平淡的。但是正因为这样,才有了后续的QE2、QE3,才有了金价的连创历史新高。

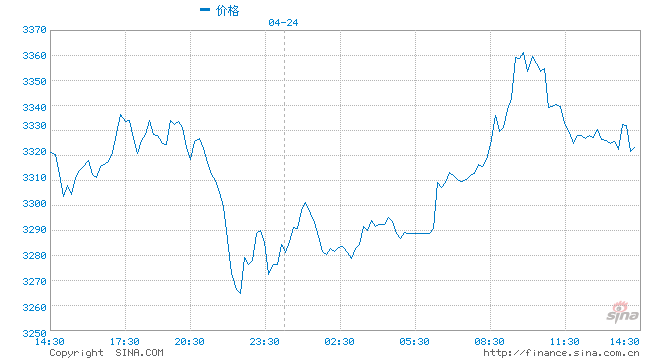

伦敦金2008年QE1开启前后走势

数据来源:Wind,安信证券研究中心

数据来源:Wind,安信证券研究中心2008-2012年美联储量化宽松政策相关情况一览

数据来源:安信证券研究中心整理

数据来源:安信证券研究中心整理2008-2013年伦敦金在QE连续升级过程中的走势

数据来源:Wind,安信证券研究中心

数据来源:Wind,安信证券研究中心此次美联储明确说QE是没有上限的,会根据情况调整计划,这和08年非常相似。也就是如果事情还在恶化的话,进一步加大QE是意料之中。

更重要的是,美联储接下来需要等到通胀预期改善到可持续的地步才会收手,而且前期美联储一直在讨论通胀目标的对称性,也就是容忍短期通胀超过目标2%一段时间。所以在美联储宽松边际抽紧之前,一定会看到通胀预期的明显持续改善,这意味着什么?意味着一定会迎来实际利率的大幅下行!

至暗时刻1.0:2008年QE1之前,由于通缩预期剧烈,虽降息但实际利率大幅上行,金价大跌;但随着QE1、美联储降息至0以及不断升级的QE2、QE3,实际利率大幅下行,金价进入牛市

数据来源:Wind,安信证券研究中心

数据来源:Wind,安信证券研究中心至暗时刻2.0:2020年3月9日以来,即使美联储紧急降息50bp,但通缩预期大增导致实际利率大幅下行,金价大跌;但我们相信,美联储降至0零率+QE重新开启甚至升级,实际利率有望下行,金价有望进入新一轮上涨。

数据来源:Wind,安信证券研究中心

数据来源:Wind,安信证券研究中心 我们认为,不能因为短期通缩预期而否定黄金的中长期配置价值,至暗时刻,继续坚定看好黄金资产!建议重点关注赤峰黄金、山东黄金、紫金矿业、恒邦股份、华钰矿业、中金黄金、湖南黄金等!

风险提示:1)疫情国际化蔓延以及对经济带来的冲击低于预期;2)美联储宽松低于预期。

附件:美联储FOMC会议声明英文全文 (美联储官网,March 15, 2020)

The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States. Global financial conditions have also been significantly affected. Available economic data show that the U.S. economy came into this challenging period on a strong footing. Information received since the Federal Open Market Committee met in January indicates that the labor market remained strong through February and economic activity rose at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending rose at a moderate pace, business fixed investment and exports remained weak. More recently, the energy sector has come under stress. On a 12‑month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation have declined; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook.In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals. This action will help support economic activity, strong labor market conditions, and inflation returning to the Committee‘s symmetric 2 percent objective.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Federal Reserve is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.To support the smooth functioning of markets for Treasury securities and agency mortgage-backed securities that are central to the flow of credit to households and businesses, over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion. The Committee will also reinvest all principal payments from the Federal Reserve‘s holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. In addition, the Open Market Desk has recently expanded its overnight and term repurchase agreement operations. The Committee will continue to closely monitor market conditions and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Randal K. Quarles. Voting against this action was Loretta J. Mester, who was fully supportive of all of the actions taken to promote the smooth functioning of markets and the flow of credit to households and businesses but preferred to reduce the target range for the federal funds rate to 1/2 to 3/4 percent at this meeting.

In a related set of actions to support the credit needs of households and businesses, the Federal Reserve announced measures related to the discount window, intraday credit, bank capital and liquidity buffers, reserve requirements, and—in coordination with other central banks—the U.S. dollar liquidity swap line arrangements. More information can be found on the Federal Reserve Board‘s website.

免责声明:自媒体综合提供的内容均源自自媒体,版权归原作者所有,转载请联系原作者并获许可。文章观点仅代表作者本人,不代表新浪立场。若内容涉及投资建议,仅供参考勿作为投资依据。投资有风险,入市需谨慎。

责任编辑:张海营

热门推荐

收起

24小时滚动播报最新的财经资讯和视频,更多粉丝福利扫描二维码关注(sinafinance)