DCE与CBOT黄豆期价关联性及动态走势实证研究(5)

http://www.sina.com.cn 2006年10月13日 00:45 大连商品交易所

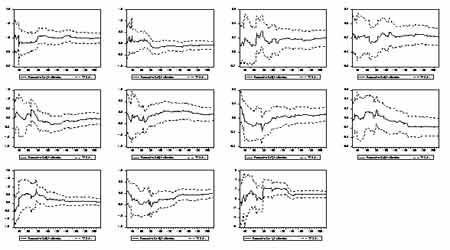

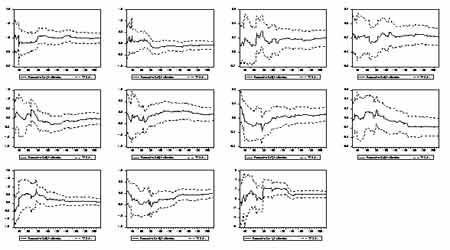

图13 动态预测模型的系数稳定性检验图

动态预测模型的系数稳定性检验图(来源:大连商品交易所)

点击此处查看全部财经新闻图片

八、结论

通过上述分析可知,我们采用协整理论的分析方法具体研究了中国大连黄豆期货价格与CBOT黄豆期货价格等变量的关联性。从单位根检验结果中可以看出,在我们分析的样本期内,我们所选数据的非平稳性是非常显著的。选取的数据均是含有一个单位根的非平稳序列。

通过所作的Granger因果关系检验结果看到:基于周数据,CBOT黄豆期货价格对大连黄豆期货价格的单向引导作用的概率达到98.7%以上。说明中国大连期货交易所黄豆期货价格受美国CBOT期货价格影响极大。国内黄豆期货价格走势完全受CBOT期货价格引导。连豆期货价格对国内大连与黑龙江黄豆现货价格具有显著的单向引导作用,大连黄豆期货的价格发现作用得到充分的发挥。

从最终我们得到的协整方程看到:从最终我们得到的协整方程看到:基于周数据,在我们的协整系统内,美国CBOT黄豆期货价格对中国大连黄豆期货价格的弹性是0.13;在我们的协整系统内,对中国大连黄豆期货价格的弹性是-0.48; 在我们的协整系统内,黑龙江黄豆现货价对中国大连黄豆期货价格的弹性是0.13。

从最终建立的短期动态方程可看到:中国大连黄豆期货价格受其自身滞后1至2周的累积影响,影响较强;中国大连黄豆期货价格受CBOT黄豆期货价格滞后1至2周累积影响,影响稍弱。中国大连黄豆期货价格受美元指数滞后1至2周累积影响,影响稍弱。二者在滞后一天的影响均大于滞后2周的影响。从最终建立的模型各项评价指标来看,该模型具有较好的统计性质,从拟合值及预测值结果看具有较好的拟合及预测精度。因此,该模型对中国大连黄豆期货价格交易风险控制具有较好的参考作用,从而可以及时规避黄豆交易风险,为套期保值者和投资者提供理论与实践的支持。

参考文献

|

? 吴冲锋、何勇、李卫东:“期货价格及其模型初探” [J],《系统工程理论方法应用》,1994年4月,第3卷第4期,71-77。 |

|

? 徐剑刚:“ 期货报酬时间序列统计特性” [J] ,《统计研究》 , 1997年第3期,70-73。 |

|

? 高辉( 2003):《大连商品期货价格协整关系与引导关系的实证研究》,《太原理工大学学报》,2003.3第21卷第1期。40-44。 |

|

? 高辉( 2004):《中国上海与英国伦敦期货价格的协整分析》,《哈尔滨师范大学学报》,2004.4。1-8。 |

|

? 高辉( 2004):《中国上海期期货交易所天然橡胶期货交易风险控制的模型研究》,上海期货交易所第二期招标课题《全球天然橡胶生产、消费及其交易风险控制研究》的研究成果。2004.12。 |

|

? 高辉( 2005):《中国上海期铜价格的形成机制的模型研究》,《浙江证券期货》2005.1,12-25。 |

|

? 高辉( 2005):《中国上海与英国伦敦期货价格收益率及波动性实证分析》,《2005中国资本市场发展与金融工程创新论文集》2005.6,中国,上海。670-688。 |

|

? 高辉( 2005):《国内外玉米的关联性及动态走势的模型预测研究》,2005.9.4公开发表于《期货日报》。 |

|

? 华仁海 仲伟俊 (2002):《对上海期货交易所金属铜量价关系的实证分析》, 《统计研究》, 2002 年第 8 期, 71-74。 |

|

? Bigman, D., Goldfarb, D., and Schechtman, E. “Futures Markets Efficiency and the Time Content of the information Sets” [J]. The Journal of Futures Markets, 1983, vol.3, 321-334. |

|

? Brooks, Robert D. & Faff, Robert W. & McKenzie, Michael D. & Mitchell, Heather. “A multi - country study of powr ARCH models and national stock market returns” [J],Journal of International Money and Finance, Elsevier,2001, vol. 19(3), pages 377-397, 6. |

|

? Baille, R.T., & Myers, R.J. “ Bivariate GARCH Estimation of the Optimal Commodity Futures Hedge” [J]. Journal of Applied Econometrics,1991, 6,109-24. |

|

? Campbell , J,Y. and Hentschel,L. “No News is good news:a asymmetric model of changing volatility In stock returns” [J]. Journal of Financial Economic.1992,31,281-318. |

|

? Cecchetti, S. R,Cumby, and S,Figlew ski., “Estimation of the optimal futures hedge” [J]. Review of Economics and Statistics, 1988, 70, pp: 623-630. |

|

? D.E. Allen and S.N. “Cruickshank, Empirical Testing of the Samuelson Hypothesis: An Application to Futures Markets in Australia, Singapore and the UK” [J], Working Paper, School of Finance and Business Economicss .Oct, 2002. |

|

? Engle RF, Granger C WJ. “Cointegration and error correction representation estimation and testing” [J]. Econometrica, 1987, 55,pp:251 ~ 276. |

|

? Fatimah Mohd. Arshad and Zainalabidin Mohamed. “Price Discovery through Crude Palm Oil Futures Market: An Economic Evaluation,” [J].in Erdener Kaynak and Mohamed Sulaiman in proceedings on Third Annual Congress on Capitalizing the Potentials of Globalization - Strategies and Dynamics of Business,Penang: International Management Development Association (IMDA) and Universities Sains Malaysia,1994. pp. 73-92. |

|

? Godfrey,L.G. “Testing against General Autoregressive and Moving Average Error Models When the Repressors Include Lagged Dependent Variables” [J] .Econometrics, 1978, 46 , pp:1293 - 1301. |

|

? Guo Jun Wu. “The determinants of asymmetric volatility” [J]. The Review of Financial Studies. 2001,14,837-859. |

|

? Harmo,Y.and Masulis,R,W.“Correlations in prices changes and volatility across interna- tional stock markets.” [J]. Reviews of Financial Studies, 1990, 3.pp:281-307. |

|

? Johansen, S. “Statistical Analysis of Cointergration Vectors” [J] .Journal of Economic Dynamics and Control1, 1988, 2, pp: 231-254. |

|

? Jian Yang, David A. Bessler, and David J. Leatham. “Asset Storability and Price Discovery in Commodity Futures Markets: A New Look” [J]. Journal of Futures Markets, March 2001.21(3):279-300. |

|

? Lai, K.S. and Lai. M.A.“ Cointegration Test for Market Efficiency” [J]. The Journal of Futures Markets, 1991. Vol, 11.567-575.

? Mittnik,S.and Rachev,S,T.“Modeling asset Returns with alternative stable distribution” [J] Econometric Review.1993, 12,261-330. |

|

? Michael D. Mackenzie, Heather Mitchell. “Power ARCH modeling of commodity futures data on the London Metal Exchange” [J]. The European Journal of Finance, Rout ledge, part of the Taylor & Francis Group, March 1, 2001,Volume 7, Number 1 , pp: 22-38. |

|

? Quan, J. “Two-Step Testing Procedure for Price Discovery Role of Futures Prices” [J]. The Journal of Futures Markets. 1992. Vol.12.139-149. |

|

? Rita Madarassy Akin. “Maturity Effects in Futures Markets: Evidence from Eleven Financial Futures Markets” [J]. Santa Cruz Center for International Economics, Working Paper Series, 2003. |

|

? Schroeder,T.C.and Goodwin,B.K.“ Price Discovery and Co integration for Live Hogs” [J] .The Journal of Futures Markets, 1991 Vol, 11, pp: 685-696. |

附表:

|

时间 |

连豆期价

(元 /吨) |

美豆连续期价

(美分 /busl) |

欧元兑美元汇率

(美元 /欧元) |

美元指数 |

哈尔滨黄豆现货价格

(元 /吨) |

大连黄豆现货价格

(元 /吨) |

|

02-5-10 |

2057.3 |

472.9 |

0.9091 |

114.5 |

1840 |

2080 |

|

02-5-17 |

2061.0 |

481.5 |

0.9116 |

114.2 |

1984 |

2080 |

|

02-5-24 |

2062.2 |

491.4 |

0.9221 |

112.7 |

2036 |

2096 |

|

02-5-31 |

2099.3 |

500.8 |

0.9342 |

111.7 |

2040 |

2100 |

|

02-6-7 |

2114.4 |

509.8 |

0.9416 |

111.1 |

2060 |

2120 |

|

02-6-14 |

2103.2 |

498.4 |

0.9444 |

110.9 |

2076 |

2136 |

|

02-6-21 |

2093.6 |

493.1 |

0.9570 |

109.6 |

2076 |

2116 |

|

02-6-28 |

2076.4 |

514.6 |

0.9843 |

106.8 |

2020 |

2100 |

|

02-7-5 |

2132.0 |

538.7 |

0.9810 |

107.0 |

2032 |

2100 |

|

02-7-12 |

2158.8 |

552.0 |

0.9902 |

105.9 |

2060 |

2112 |

|

02-7-19 |

2099.2 |

575.8 |

1.0090 |

104.5 |

2060 |

2120 |

|

02-7-26 |

2088.6 |

574.4 |

0.9955 |

105.8 |

2096 |

2132 |

|

02-8-2 |

2095.8 |

549.3 |

0.9823 |

107.0 |

2200 |

2196 |

|

02-8-9 |

2101.8 |

550.2 |

0.9712 |

108.1 |

2268 |

2204 |

|

02-8-16 |

2143.0 |

587.2 |

0.9818 |

106.9 |

2300 |

2224 |

|

02-8-23 |

2198.4 |

555.1 |

0.9753 |

107.6 |

2340 |

2320 |

|

02-8-30 |

2182.4 |

555.2 |

0.9802 |

107.1 |

2340 |

2350 |

|

02-9-6 |

2183.5 |

554.7 |

0.9903 |

106.1 |

2340 |

2350 |

|

02-9-13 |

2190.0 |

576.3 |

0.9762 |

107.5 |

2340 |

2350 |

|

02-9-20 |

2206.0 |

569.3 |

0.9766 |

107.7 |

2254 |

2350 |

|

02-9-27 |

2198.6 |

558.8 |

0.9783 |

107.7 |

2008 |

2200 |

|

02-9-30 |

2158.0 |

522.4 |

0.9903 |

107.0 |

1957 |

2100 |

|

02-10-11 |

2156.8 |

527.6 |

0.9851 |

107.3 |

1943 |

2060 |

|

02-10-18 |

2174.0 |

544.7 |

0.9784 |

107.9 |

1972 |

2060 |

|

02-10-25 |

2201.4 |

552.9 |

0.9764 |

108.1 |

2020 |

2104 |

|

02-11-1 |

2227.2 |

558.4 |

0.9876 |

106.8 |

2088 |

2152 |

|

02-11-8 |

2270.8 |

569.5 |

1.0044 |

105.4 |

2152 |

2216 |

|

02-11-15 |

2276.8 |

564.9 |

1.0084 |

104.8 |

2120 |

2200 |

|

02-11-22 |

2338.0 |

571.2 |

1.0021 |

105.7 |

2164 |

2224 |

|

02-11-29 |

2376.6 |

575.8 |

0.9940 |

106.5 |

2200 |

2280 |

|

02-12-6 |

2457.6 |

566.9 |

1.0003 |

106.0 |

2356 |

2366 |

|

02-12-13 |

2451.8 |

568.3 |

1.0136 |

104.9 |

2380 |

2384 |

|

02-12-20 |

2449.6 |

560.7 |

1.0258 |

103.6 |

2400 |

2412 |

|

02-12-27 |

2514.8 |

570.8 |

1.0327 |

103.1 |

2424 |

2456 |

|

03-1-3 |

2582.3 |

572.3 |

1.0438 |

102.4 |

2420 |

2460 |

|

03-1-10 |

2683.8 |

575.1 |

1.0487 |

101.9 |

2436 |

2460 |

|

03-1-17 |

2522.4 |

550.5 |

1.0573 |

101.1 |

2472 |

2460 |

|

03-1-24 |

2509.0 |

561.6 |

1.0751 |

100.0 |

2390 |

2444 |

|

03-1-29 |

2508.7 |

567.4 |

1.0838 |

99.4 |

2400 |

2460 |

|

03-2-14 |

2563.6 |

569.2 |

1.0765 |

100.1 |

2420 |

2460 |

|

03-2-21 |

2614.5 |

571.9 |

1.0759 |

99.9 |

2420 |

2460 |

|

03-2-28 |

2657.6 |

577.3 |

1.0784 |

99.7 |

2440 |

2464 |

|

03-3-7 |

2578.2 |

569.0 |

1.0946 |

98.5 |

2460 |

2476 |

|

03-3-14 |

2643.2 |

570.4 |

1.0926 |

98.5 |

2396 |

2468 |

|

03-3-21 |

2695.2 |

573.0 |

1.0580 |

101.0 |

2434 |

2480 |

|

03-3-28 |

2706.0 |

573.6 |

1.0688 |

100.7 |

2454 |

2494 |

|

03-4-4 |

2711.2 |

582.1 |

1.0813 |

99.8 |

2510 |

2540 |

|

03-4-11 |

2746.2 |

601.2 |

1.0739 |

100.5 |

2500 |

2550 |

|

03-4-18 |

2768.0 |

614.5 |

1.0846 |

99.5 |

2500 |

2550 |

|

03-4-25 |

2727.2 |

606.2 |

1.0980 |

98.7 |

2552 |

2606 |

|

03-4-30 |

2762.0 |

617.7 |

1.9660 |

97.8 |

2570 |

2620 |

|

03-5-16 |

2752.8 |

645.2 |

1.1473 |

94.7 |

2590 |

2620 |

|

03-5-23 |

2736.8 |

634.8 |

1.1710 |

93.3 |

2590 |

2620 |

|

03-5-30 |

2672.8 |

627.0 |

1.1812 |

93.3 |

2576 |

2604 |

|

03-6-6 |

2643.4 |

617.7 |

1.1736 |

93.5 |

2538 |

2580 |

|

03-6-13 |

2690.6 |

625.6 |

1.1751 |

93.0 |

2530 |

2580 |

|

03-6-20 |

2675.6 |

625.3 |

1.1723 |

93.1 |

2530 |

2580 |

|

03-6-27 |

2660.0 |

633.7 |

1.1490 |

94.5 |

2520 |

2560 |

|

03-7-4 |

2676.8 |

616.0 |

1.1519 |

94.4 |

2520 |

2560 |

|

03-7-11 |

2689.8 |

607.7 |

1.1330 |

95.5 |

2520 |

2560 |

|

03-7-18 |

2631.8 |

579.9 |

1.1223 |

96.6 |

2516 |

2560 |

|

03-7-25 |

2592.4 |

554.6 |

1.1428 |

95.8 |

2500 |

2560 |

|

03-8-1 |

2397.2 |

534.4 |

1.1356 |

96.1 |

2500 |

2560 |

|

03-8-8 |

2415.2 |

524.6 |

1.1351 |

96.1 |

2500 |

2560 |

|

03-8-15 |

2448.8 |

547.7 |

1.1297 |

96.3 |

2500 |

2560 |

|

03-8-22 |

2500.4 |

578.8 |

1.1042 |

97.9 |

2512 |

2560 |

|

03-8-29 |

2495.4 |

584.6 |

1.0893 |

98.0 |

2520 |

2560 |

|

03-9-5 |

2496.0 |

585.3 |

1.0932 |

78.6 |

2520 |

2564 |

|

03-9-12 |

2516.0 |

604.6 |

1.1189 |

96.6 |

2530 |

2580 |

|

03-9-19 |

2597.4 |

622.4 |

1.1268 |

95.9 |

2564 |

2628 |

|

03-9-26 |

2654.6 |

653.7 |

1.1477 |

93.8 |

2580 |

2630 |

|

03-9-30 |

2749.6 |

674.1 |

1.1630 |

92.8 |

2580 |

2630 |

|

03-10-10 |

2844.7 |

694.4 |

1.1783 |

91.7 |

2497 |

2700 |

|

03-10-17 |

3035.8 |

731.2 |

1.1664 |

92.2 |

2716 |

2806 |

|

03-10-24 |

3155.6 |

747.0 |

1.1733 |

91.8 |

2880 |

3086 |

|

03-10-31 |

3273.6 |

784.5 |

1.1658 |

92.0 |

2936 |

3150 |

|

03-11-7 |

3201.6 |

769.4 |

1.1465 |

93.5 |

2932 |

3170 |

|

03-11-14 |

3057.4 |

772.7 |

1.1631 |

92.2 |

2842 |

3130 |

|

03-11-21 |

2912.8 |

763.6 |

1.1884 |

90.8 |

2858 |

3090 |

|

03-11-28 |

2861.6 |

746.0 |

1.1871 |

90.9 |

2860 |

3058 |

|

03-12-5 |

2978.8 |

768.4 |

1.2079 |

89.6 |

2860 |

3028 |

|

03-12-12 |

3018.4 |

777.8 |

1.2232 |

88.7 |

2860 |

3020 |

|

03-12-19 |

2945.2 |

766.0 |

1.2367 |

88.2 |

2880 |

3100 |

|

03-12-26 |

2934.0 |

761.5 |

1.2419 |

87.8 |

2900 |

3100 |

|

04-1-2 |

3030.8 |

790.3 |

1.2547 |

86.9 |

2900 |

3100 |

|

04-1-9 |

3046.4 |

796.3 |

1.2734 |

85.6 |

2912 |

3100 |

|

04-1-16 |

3100.4 |

834.7 |

1.2623 |

86.3 |

2924 |

3100 |

|

04-1-30 |

3030.5 |

814.2 |

1.2430 |

87.0 |

2940 |

3100 |

|

04-2-6 |

3039.2 |

814.6 |

1.2538 |

86.8 |

2956 |

3100 |

|

04-2-13 |

3125.2 |

834.2 |

1.2750 |

85.6 |

2960 |

3100 |

|

04-2-20 |

3191.3 |

869.6 |

1.2676 |

86.1 |

2960 |

3100 |

|

04-2-27 |

3327.2 |

928.0 |

1.2559 |

87.1 |

2996 |

3132 |

|

04-3-5 |

3402.0 |

940.6 |

1.2273 |

88.5 |

3100 |

3352 |

|

04-3-12 |

3364.2 |

937.3 |

1.2304 |

88.6 |

3232 |

3402 |

|

04-3-19 |

3417.4 |

1000.8 |

1.2277 |

88.4 |

3276 |

3460 |

|

04-3-26 |

3552.0 |

1034.6 |

1.2212 |

88.5 |

3360 |

3538 |

|

04-4-2 |

3501.4 |

1019.8 |

1.2222 |

88.1 |

3532 |

3644 |

|

04-4-8 |

3533.8 |

1009.4 |

1.2088 |

88.8 |

3556 |

3692 |

|

04-4-16 |

3357.6 |

975.9 |

1.1988 |

89.8 |

3560 |

3692 |

|

04-4-23 |

3275.6 |

954.4 |

1.1892 |

90.6 |

3584 |

3680 |

|

04-4-30 |

3223.6 |

1002.5 |

1.1918 |

90.8 |

3592 |

3680 |

|

04-5-14 |

3168.0 |

984.3 |

1.1862 |

91.6 |

3600 |

3680 |

|

04-5-21 |

2965.2 |

885.6 |

1.1981 |

90.8 |

3592 |

3658 |

|

04-5-28 |

2959.0 |

851.4 |

1.2140 |

89.5 |

3564 |

3610 |

|

04-6-4 |

2985.0 |

839.6 |

1.2239 |

88.8 |

3500 |

3600 |

|

04-6-11 |

2898.0 |

848.8 |

1.2146 |

89.1 |

3470 |

3600 |

|

04-6-18 |

2876.8 |

872.4 |

1.2085 |

89.5 |

3450 |

3600 |

|

04-6-25 |

2885.0 |

907.2 |

1.2123 |

89.1 |

3420 |

3540 |

|

04-7-2 |

2915.8 |

857.4 |

1.2189 |

88.7 |

3400 |

3500 |

|

04-7-9 |

2825.4 |

815.5 |

1.2345 |

87.8 |

3250 |

3350 |

|

04-7-16 |

2761.8 |

758.6 |

1.2380 |

87.6 |

3210 |

3338 |

|

04-7-23 |

2713.2 |

693.4 |

1.2269 |

88.2 |

3150 |

3330 |

|

04-7-30 |

2667.0 |

637.0 |

1.2061 |

89.7 |

3150 |

3330 |

|

04-8-6 |

2630.2 |

571.6 |

1.2093 |

89.4 |

3150 |

3330 |

|

04-8-13 |

2596.8 |

578.1 |

1.2269 |

88.5 |

3150 |

3330 |

|

04-8-20 |

2615.8 |

591.9 |

1.2343 |

87.9 |

3150 |

3330 |

|

04-8-27 |

2687.0 |

616.6 |

1.2085 |

89.4 |

3120 |

3250 |

|

04-9-3 |

2749.0 |

624.9 |

1.2127 |

89.2 |

2980 |

3250 |

|

04-9-10 |

2748.2 |

586.6 |

1.2160 |

89.0 |

2900 |

3250 |

|

04-9-17 |

2719.8 |

562.4 |

1.2208 |

88.8 |

2780 |

3250 |

|

04-9-24 |

2674.8 |

537.2 |

1.2257 |

88.4 |

2748 |

3230 |

|

04-9-30 |

2676.0 |

531.9 |

1.2360 |

87.8 |

2830 |

3150 |

|

04-10-8 |

2674.0 |

528.4 |

1.2412 |

87.5 |

2800 |

3050 |

|

04-10-15 |

2634.8 |

522.0 |

1.2380 |

87.6 |

2716 |

2910 |

|

04-10-22 |

2611.4 |

526.5 |

1.2573 |

86.4 |

2568 |

2620 |

|

04-10-29 |

2639.2 |

533.5 |

1.2759 |

85.2 |

2532 |

2550 |

|

04-11-5 |

2627.0 |

515.2 |

1.2809 |

84.7 |

2568 |

2550 |

|

04-11-12 |

2637.2 |

517.1 |

1.2919 |

84.1 |

2600 |

2550 |

|

04-11-19 |

2633.0 |

546.9 |

1.2985 |

83.6 |

2584 |

2566 |

|

04-11-26 |

2659.2 |

554.3 |

1.3165 |

82.5 |

2580 |

2560 |

|

04-12-3 |

2591.2 |

529.7 |

1.3317 |

81.6 |

2580 |

2600 |

|

04-12-10 |

2582.8 |

528.0 |

1.3350 |

81.9 |

2580 |

2600 |

|

04-12-17 |

2636.2 |

547.3 |

1.3307 |

82.1 |

2580 |

2600 |

|

04-12-24 |

2640.6 |

549.1 |

1.3433 |

81.6 |

2560 |

2600 |

|

04-12-31 |

2618.2 |

549.9 |

1.3599 |

80.8 |

2560 |

2720 |

|

05-1-7 |

2587.0 |

532.8 |

1.3196 |

83.0 |

2560 |

2720 |

|

05-1-14 |

2609.8 |

536.2 |

1.3157 |

82.8 |

2568 |

2730 |

|

05-1-21 |

2586.3 |

517.7 |

1.3000 |

83.5 |

2560 |

2730 |

|

05-1-28 |

2575.4 |

519.7 |

1.3033 |

83.5 |

2560 |

2730 |

|

05-2-4 |

2533.8 |

505.6 |

1.2992 |

83.8 |

2540 |

2730 |

|

05-2-18 |

2598.0 |

546.3 |

1.3061 |

83.6 |

2540 |

2730 |

|

05-2-25 |

2678.3 |

580.0 |

1.3229 |

82.7 |

2542 |

2730 |

|

05-3-4 |

2832.6 |

619.2 |

1.3182 |

82.8 |

2580 |

2758 |

|

05-3-11 |

2939.2 |

634.5 |

1.3369 |

81.9 |

2740 |

2800 |

|

05-3-18 |

3149.2 |

666.2 |

1.3352 |

81.9 |

2768 |

2830 |

|

05-3-24 |

3058.3 |

626.4 |

1.3042 |

83.6 |

2760 |

2850 |

|

05-4-1 |

3093.6 |

626.4 |

1.2921 |

84.3 |

2760 |

2850 |

|

05-4-8 |

3071.8 |

618.1 |

1.2885 |

84.7 |

2760 |

2850 |

|

05-4-15 |

3042.2 |

618.1 |

1.2908 |

84.5 |

2760 |

2850 |

|

05-4-22 |

3063.2 |

634.6 |

1.3057 |

83.7 |

2760 |

2850 |

|

05-4-29 |

3087.8 |

634.1 |

1.2932 |

84.1 |

2760 |

2850 |

|

05-5-13 |

3067.2 |

628.1 |

1.2765 |

85.1 |

2744 |

2850 |

|

05-5-20 |

3025.8 |

627.7 |

1.2622 |

86.2 |

2740 |

2850 |

|

05-5-27 |

3099.0 |

659.1 |

1.2570 |

86.5 |

2724 |

2850 |

|

05-6-3 |

3105.3 |

677.3 |

1.2254 |

88.0 |

2740 |

2850 |

|

05-6-10 |

3105.4 |

671.8 |

1.2222 |

88.0 |

2740 |

2850 |

|

05-6-17 |

3103.6 |

699.4 |

1.2125 |

88.6 |

2740 |

2850 |

|

05-6-24 |

3184.6 |

736.3 |

1.2114 |

88.6 |

2760 |

2850 |

|

05-7-1 |

3008.4 |

671.9 |

1.2070 |

89.2 |

2778 |

2850 |

|

05-7-8 |

3051.3 |

694.7 |

1.1932 |

90.4 |

2770 |

2850 |

|

05-7-15 |

3047.8 |

708.8 |

1.2103 |

89.4 |

2770 |

2850 |

|

05-7-22 |

2961.0 |

684.5 |

1.2093 |

89.7 |

2770 |

2850 |

|

05-7-29 |

2897.4 |

675.0 |

1.2084 |

89.6 |

2770 |

2850 |

|

05-8-5 |

2861.4 |

672.7 |

1.2288 |

88.3 |

2762 |

2850 |

|

05-8-12 |

2800.0 |

647.2 |

1.2399 |

87.5 |

2750 |

2850 |

|

05-8-19 |

2702.8 |

610.2 |

1.2266 |

88.0 |

2746 |

2850 |

|

05-8-26 |

2677.4 |

599.6 |

1.2260 |

87.9 |

2740 |

2850 |

|

05-9-2 |

2688.2 |

592.9 |

1.2363 |

87.4 |

2740 |

2850 |

|

05-9-9 |

2711.4 |

595.5 |

1.2444 |

86.7 |

2740 |

2850 |

|

05-9-16 |

2695.0 |

578.1 |

1.2240 |

87.8 |

2728 |

2850 |

|

05-9-23 |

2710.8 |

576.0 |

1.2134 |

88.6 |

2696 |

2850 |

|

05-9-30 |

2685.2 |

564.3 |

1.2031 |

89.4 |

2520 |

2810 |

|

05-10-14 |

2703.6 |

577.1 |

1.2040 |

89.6 |

2500 |

2550 |

|

05-10-21 |

2710.2 |

584.5 |

1.1991 |

90.0 |

2500 |

2550 |

|

05-10-28 |

2644.8 |

572.1 |

1.2070 |

89.5 |

2460 |

2550 |

|

05-11-4 |

2634.6 |

576.7 |

1.1966 |

90.3 |

2442 |

2550 |

|

05-11-11 |

2642.2 |

583.1 |

1.1760 |

91.6 |

2440 |

2550 |

|

05-11-18 |

2697.4 |

582.7 |

1.1715 |

92.1 |

2440 |

2550 |

|

05-11-25 |

2621.8 |

570.8 |

1.1747 |

91.8 |

2440 |

2550 |

|

05-12-2 |

2546.2 |

558.9 |

1.1778 |

91.6 |

2350 |

2500 |

|

05-12-9 |

2579.6 |

566.6 |

1.1792 |

91.4 |

2350 |

2470 |

|

05-12-16 |

2679.4 |

590.5 |

1.1974 |

90.1 |

2350 |

2450 |

|

05-12-23 |

2737.0 |

608.9 |

1.1888 |

90.6 |

2350 |

2450 |

|

05-12-30 |

2732.0 |

605.4 |

1.1832 |

91.1 |

2350 |

2450 |

|

06-1-9 |

2724.3 |

592.8 |

1.1961 |

90.2 |

2350 |

2450 |

|

06-1-13 |

2716.5 |

580.2 |

1.2089 |

89.2 |

2350 |

2450 |

|

06-1-20 |

2667.8 |

567.7 |

1.2104 |

89.2 |

2360 |

2450 |

|

06-1-27 |

2699.8 |

574.8 |

1.2230 |

88.5 |

2400 |

2450 |

|

06-2-10 |

2740.0 |

581.7 |

1.1953 |

90.4 |

2400 |

2450 |

|

06-2-17 |

2740.0 |

589.3 |

1.1901 |

90.6 |

2408 |

2510 |

|

06-2-24 |

2754.3 |

577.9 |

1.1905 |

90.6 |

2420 |

2600 |

|

06-3-3 |

2749.4 |

595.1 |

1.1954 |

90.0 |

2420 |

2600 |

|

06-3-10 |

2759.6 |

590.5 |

1.1923 |

90.6 |

2420 |

2600 |

|

06-3-17 |

2748.4 |

581.8 |

1.2074 |

89.7 |

2420 |

2600 |

|

06-3-24 |

2720.2 |

574.8 |

1.2067 |

89.8 |

2404 |

2600 |

|

06-3-31 |

2727.0 |

580.4 |

1.2063 |

89.9 |

2368 |

2600 |

|

06-4-7 |

2671.8 |

561.2 |

1.2206 |

89.2 |

2360 |

2600 |

|

06-4-13 |

2636.0 |

560.3 |

1.2113 |

89.5 |

2360 |

2600 |

|

06-4-21 |

2658.6 |

575.0 |

1.2320 |

88.2 |

2348 |

2564 |

|

06-4-28 |

2685.0 |

592.6 |

1.2490 |

87.0 |

2300 |

2420 |

|

06-5-12 |

2800.6 |

607.2 |

1.2805 |

84.5 |

2316 |

2420 |

|

06-5-19 |

2822.0 |

599.2 |

1.2799 |

84.6 |

2340 |

2420 |

|

06-5-26 |

2808.0 |

583.6 |

1.2788 |

84.8 |

2340 |

2420 |

|

06-6-2 |

2822.5 |

589.6 |

1.2850 |

84.5 |

2324 |

2420 |

|

06-6-9 |

2860.0 |

593.4 |

1.2769 |

85.1 |

2300 |

2420 |

|

06-6-16 |

2836.2 |

595.5 |

1.2600 |

86.1 |

2300 |

2420 |

|

06-6-23 |

2806.4 |

604.8 |

1.2583 |

86.3 |

2288 |

2420 |

|

06-6-30 |

2784.2 |

607.0 |

1.2629 |

86.2 |

2264 |

2420 |

|

06-7-7 |

2804.3 |

628.3 |

1.2780 |

85.3 |

2256 |

2420 |

|

06-7-14 |

2681.0 |

627.7 |

1.2709 |

85.6 |

2236 |

2420 |

大连商品交易所 期货学院学员 陈佳蕴

[上一页] [1] [2] [3] [4] [5]

|

|

|