特斯拉汽车财报解读:业绩良好前景可期

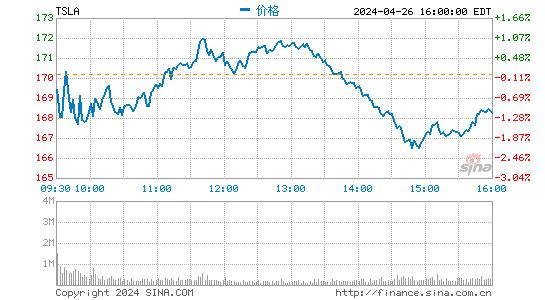

新浪财经讯 北京时间8月8日晚间消息,特斯拉汽车(TSLA)周二晚发布了季报,多数业绩数字达到或好于预期,投资者对此予以充分肯定,推动特斯拉的股票在周二盘后大涨12%。下面略微细致地观察一下特斯拉的最新财报。

本文为英文原文节译,完整英文版本附后供投资者参考。

特斯拉的季营收为4.01亿美元,低于前一季度的5.55亿美元,应注意的是,特斯拉因租赁项目拥有1.46亿美元递延营收,如果包括这一数字,特斯拉的营收将大幅增至5.48亿美元。

考察非GAAP(美国通用会计准则)方面的数字,特斯拉的财报更好。如计入S车型的1934万美元递延毛利,特斯拉的毛利将从1亿美元增至1.2亿美元。若不计股票薪酬,特斯拉毛利为1.2089亿美元。不仅如此,若不计股票薪酬和提前偿还能源部的贷款,特斯拉净盈利2628万美元。最后,特斯拉每股净利润为20美分,超过前一财季的12美分,更好于上年同期的每股亏损89美分。

更为重要的是,特斯拉今年余下时间内的前景令人鼓舞。特斯拉预计将提高生产速度,将某些汽车销往欧洲。预计欧洲市场销售的汽车毛利率更高,特斯拉预计85千瓦时版的汽车需求旺盛,这应有利于维持特斯拉的高毛利率。欧洲市场的加入,特斯拉汽车的平均售价应该会上涨,这是因为鉴于欧洲的能源成本比北美要高,节能车在欧洲往往能卖出更高价格。

特斯拉预计本季度交付了略超过5千辆的S型车,截至2013年底全球范围内将交付2.1万辆。特斯拉预计S型车的利润率将上涨,但ZEV(零排放汽车)贷款营收将下降,预计这将导致下一季度毛利率在20-23%之间。至今年底时,特斯拉不计ZEV信贷的毛利率应会达到25%,将达成公司此前公布的预定目标。

特斯拉预计未来两个季度现金流将为正,这对投资者来说是一个好消息。特斯拉宣布需求持续增长但公司的任何业绩数字没有被牺牲值得关注。此外,特斯拉宣布如果国际市场需求持续强劲,2014年有望售出4万辆以上的汽车。

总的来说,特斯拉刚过去的财季表现不错,管理层对未来非常乐观。特斯拉购买更多土地、增加研发投资和重视扩张都令人欣慰。另一方面,大部分的近期和中期内成功已在当前股价中得到体现。但是,这并不意味着这只股票不会进一步上涨。特斯拉拥有很多有信心的投资者,空头比例也较高。目前看来导致该股下跌的推动因素不太多,因为需要大量卖家或空头才能导致该股下跌,而多数卖家已出售,多数空头已建仓。未来几个季度中特斯拉往何处去,及整个局势将如何发展令人关注。我关注的一件事情是量化宽松的削减,因为一旦市场因恐惧而大幅下跌,前期涨势强劲的股票将是首先受难者之一。未来几个月中,投资特斯拉似乎不是滥赌。(立悟/编译)

Tesla: Another Good Quarter, Encouraging Outlook

On Tuesday evening, Tesla (TSLA) announced its quarterly earnings, and most of the company's figures were either in-line or better than expectations. Investors cheered by buying up more shares of the company, driving the share price up by as much as 12% in the after-hours. Let's take a look at Tesla's last quarter。

The company generated $401 million in revenues, up from $22 million generated in the same quarter last year, but down from the $555 million generated in the previous quarter. Keep in mind that Tesla has $146 million in deferred revenues due to its lease program and when we include this number, the revenues jump to $548 million. The gross profit in the quarter was $100.48 million, indicating a gross margin of 24.69% not excluding the ZEV credits. The company posted an operating loss of $11.79 million due to itemized expenditures of $52 million in research and development and $60 million in selling, general and administrative (these expenses include $19.26 million of stock-based-compensations)。

For the quarter, Tesla reported a net loss of $30.5 million. The company reported a negative cash flow of $38.19 million in operations, $27.17 million in investing activities and it generated $597 million from financial activities such as the secondary public offering it held during the quarter. As a result, Tesla currently has $749 million in cash and $578 million in long term debt。

In non-GAAP financials, we are looking at a nicer picture. If we include the $19.34 million of deferred gross profit due to leasing of Model S, the company's gross profit jumps from $100 million to $120 million. Excluding stock based compensations, the company's gross profit was $120.89 million for the quarter. Furthermore, excluding stock based compensations and the early extinguishment of the Department of Energy loans, the company posted a net profit of $26.28 million. Finally, the company's net income per share was 20 cents, up from 12 cents in the last quarter and a loss of 89 cents in the same quarter a year ago。

More importantly, Tesla's outlook for the rest of the year was pretty encouraging. The company expects to increase its production rate further and move some cars to Europe to sell them there. European cars are expected to have higher margins and the company expects a strong demand for its 85 kWh cars, which should keep the margins high. With the addition of European markets, the average sale price should go higher because energy-efficient cars tend to sell for higher prices in Europe due to higher energy costs in the continent compared to North America. Tesla expects to deliver a little more than 5,000 Model S cars this quarter and 21,000 cars globally by the end of 2013. Moving forward, the company expects higher margins on the cars sold but lower ZEV credit revenue, which should move its gross margin to 20-23% range for the next quarter. Towards the end of the year, the gross margins excluding ZEV credits should reach 25%, which is in-line with the previously announced target of the company。

The company expects to spend additional capital on growth measures, such as the purchase of additional land that was announced last month, increased research and development expenses, new retail stores, service centers and Supercharger locations. These are one-time investments that should pay themselves off in the following years as long as the company is profitable. The next 2 quarters, the company expects to be cash flow positive which is nice to hear. The company announced a "growing demand" without specifying any numbers which is interesting. On the other hand, the company announced that it could sell more than 40,000 cars in 2014 if the demand continues to be strong in the international markets。

Tesla generally had a decent quarter and the management seems very optimistic about the future. I like the fact that it is buying additional land, ramping up research and development investments and getting serious about expanding. On the other hand, most of the short and medium term success is already priced in by the investors. Of course, this doesn't mean that the stock price can't go up further. Tesla has a lot of faithful investors and a high rate of short interest. At this point, there don't seem to be many catalysts to the downside because it takes a large number of sellers or shorters to bring a company's share price down, and most sellers already sold and most shorters already shorted at this point. It will be interesting to see where Tesla goes and how the story develops in the following quarters. One thing I would watch out for is tapering of the quantitative easing because when the market goes down strongly based on fear, the high-flyers are first ones to suffer. For the next few months, Tesla doesn't sound like a bad bet。

进入【新浪财经股吧】讨论