来源:人民币交易与研究

香港为维持联系汇率制又投入了数十亿美元。分析人士正在关注香港金融体系的资金规模与当地借贷成本之间的相互作用,他们认为,香港的这一轮汇率干预远未结束。

图文|BBG

图文|BBG分析人士们正在关注香港金融体系的资金规模与当地借贷成本之间的相互作用。据美银美林(Bank of America Merrill Lynch)和华侨银行永亨银行(OCBC Wing Hang Bank Ltd.)说,在港元开始大幅升值之前,做空港元仍将保持盈利,在此之前,香港金管局将至少再斥资500亿港元(合64亿美元)维持港元盯住美元的联系汇率制。

Analysts are watching the interplay between the amount of money in the city’s financial system and local borrowing costs. Shorting the Hong Kong dollar will remain profitable until the latter starts to go up sharply, and the monetary authority will spend at least another HK$50 billion ($6.4 billion) defending the peg before that happens, according to Bank of America Merrill Lynch and OCBC Wing Hang Bank Ltd.

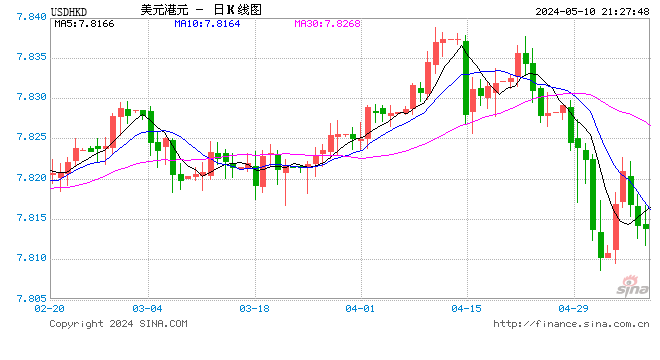

数据:美元兑港币|Wind 路闻卓立

数据:美元兑港币|Wind 路闻卓立自1983年以来,港币一直与美元挂钩,从而致其通常是一种沉闷的货币,波动率很低。除非它不盯住美元。虽然2005年设定的1美元兑7.75港元至7.85港元的交易区间从未被打破,但它仍在经受考验。这迫使实为香港央行的香港金融管理局(Hong Kong Monetary Authority,简称:金管局)履行其职责并进行干预,引发了人们对这种情况能持续多久以及对香港整体经济的影响的疑问。

Pegged to the U.S. dollar since 1983, the Hong Kong dollar is usually a dull currency. Except when it isn’t. While its trading band of HK$7.75 to HK$7.85 per U.S. dollar, set in 2005, has never been broken, it keeps getting tested. That forces the Hong Kong Monetary Authority, the de-facto central bank, to follow its mandate and intervene, raising questions about how long this can continue and the implications for Hong Kong’s wider economy.

1 我们应该担忧吗?

不是现在。尽管香港政府采取了种种干预措施,但香港仍拥有逾4300亿美元的外汇储备,是港元流通量的7倍。香港还有超过1万亿港元(合1,270亿美元)的未偿还外汇基金票据,因此可以通过允许债务到期来注入现金。可能会破坏局面的,是类似于1997年亚洲金融危机期间,投资者对港币的大规模投机性攻击。即使在那里,央行也赢了。当然,香港与中国有着特殊的联系,中国拥有世界上最大的外汇储备,超过3万亿美元。

Not for now. Despite all its interventions, the city still has more than $430 billion of foreign reserves, or seven times the Hong Kong dollars in circulation. The city also has more than HK$1 trillion ($127 billion) of exchange fund bills outstanding, so it could inject cash by allowing that debt to mature. What might rock the boat would be massive speculative attacks on the currency as experienced in the midst of the Asian financial crisis in 1997. Even there, the central bank won. And of course Hong Kong has a special connection with China, which has the world’s largest foreign-exchange reserves at more than $3 trillion.

2 1997年发生了什么?

随着始于泰铢贬值的危机蔓延,香港股市的乐观情绪迅速演变为恐慌性抛售,并引发货币贬值。货币当局坚决反对投机,允许隔夜利率跳升至300%,因现金流出银行间市场。这足以抵消对冲基金的攻击,因为本地银行只能满足当地的需求,因此没有港元留给卖空者融资。

As the crisis that began with a devaluation of the Thai baht spread, optimism in Hong Kong stocks quickly turned into panic selling and triggered a run on the currency. The monetary authority held firm against speculators, allowing overnight interest rates to jump to 300 percent as cash drained out of the interbank market, where banks exchange different currencies. This was enough to kill off the hedge-fund attack as local banks could only meet their own needs, so there were no Hong Kong dollars left to finance short sellers.

3. 近期是什么推动了港元的走势?

通常是利率,当地利率与美国利率不同步时。例如,随着美联储在2018年不断加息,投资者抛售当地美元、购买收益率更高的美元变得更具吸引力。去年4月,港元跌至交易区间的低端,因此金管局开始买进。随后,在2018年9月21日的一个戏剧性交易日中,港元飙升出危险区域。当时的分析人士将原因指向香港加息的前景、止损指令,甚至即将到来的假期等。不管原因是什么,它都没有持续下去,干预在2019年恢复。上周,即3月9日至15日当周,香港金管局斥资约7亿美元购买港元。

Often it’s interest rates, when local ones don’t move in tandem with the U.S. For example, as the Federal Reserve kept raising rates in 2018, it became more attractive for investors to sell local dollars and buy higher-yielding U.S. dollars. The Hong Kong dollar fell to the lower end of its trading band that April, so the HKMA began buying. Then, in one dramatic trading session on Sept. 21, 2018, the Hong Kong dollar surged out of the danger zone. Analysts at the time cited the prospect of higher rates in the city, stop-loss orders and even upcoming holidays as likely triggers. Whatever the reason, it didn’t last, and interventions resumed in 2019. In the week of March 9-15 the authority spent about $700 million buying Hong Kong dollars.

4. 香港为何没有镜映美联储?

香港试图想跟美联储同步。每次美联储提高基准利率,金管局都会提高基准利率,但收效甚微。这是因为,基准利率是当局向银行提供隔夜资金的利率——在银行体系多年来现金充裕的情况下,这一利率几乎毫无意义。全球主要央行纷纷印钞应对全球金融危机,作为金融中心的香港吸引了大量资金流入。至少在2015年至2016年中国收紧资本管制以支撑人民币走软之前,香港还受益于中国内地资本外流,因为投资者寻求分散投资组合。资金充裕的香港银行几乎没有面临大幅提高银行间利率的压力。

It tries to. Every time the Fed lifts its benchmark rate, the HKMA raises its base rate, but with little effect. That’s because the base rate is the one at which the authority offers overnight funds to banks -- hardly relevant when the banking system has been brimming with cash for years. Hong Kong, as a financial hub, drew massive inflows as the world’s major central banks printed money in response to the global financial crisis. The city also benefited from an exodus of capital from mainland China as investors sought to diversify their portfolios, at least until Chinese officials tightened capital controls to support a weakening yuan in 2015-16. Flush with cash, Hong Kong banks are under little pressure to raise interbank interest rates significantly.

数据|Wind 路闻卓立

数据|Wind 路闻卓立5. 这种情况会持续多久?

由于香港金管局一直在大量买入港元,2018年的多次干预行动使银行间流动资金的总余额减少了一半以上。目前,香港的借贷规模仅略高于700亿港元(约合90亿美元),与近期历史水平相比处于较低水平,但香港与美国的借贷成本差距仍然很大。一些分析人士说,香港将需要再支出400亿至600亿港元,以提高本地借贷成本对政府干预的反应能力。Hibor作为大多数新抵押贷款的浮动利率,是收紧流动性的第一个指标。2月一个月期Libor一度跌至0.91%的低位,而美国Libor则为2.49%,但截至3月15日已攀升至1.55%。

Multiple interventions in 2018 have more than halved that cash pool, known as the aggregate balance of interbank liquidity, because the monetary authority has been buying up Hong Kong dollars from them. Right now, it sits at just over HK$70 billion (about $9 billion), low relative to recent history, but the gap between Hong Kong and U.S. borrowing costs remains wide. Some analysts say Hong Kong will need to spend another HK$40 billion to HK$60 billion to make local borrowing costs more responsive to intervention. Hibor, the floating rate on most new mortgages, is the first indicator of tightening liquidity. The one-month rate fell to as low as 0.91 percent in February, compared with 2.49 percent for U.S. Libor, but climbed to 1.55 percent as of March 15.

6. 为什么盯住美元很重要?

首先,港币盯住美元被认为是金融稳定和经济的一个支柱。投资者将资金存放在香港,因为香港的货币相对安全。与此同时,全球最昂贵的房地产市场之一香港的房地产市场随着借贷成本上升,也显示出降温的迹象。去年9月,香港地方银行10多年来首次上调了基准利率。基准利率通常是抵押贷款上限的基础。花旗集团(Citigroup Inc.)和里昂证券(CLSA Ltd.)也预测房价将下跌。

First and foremost, the currency peg is considered an anchor for financial stability and the economy. Investors park their money in Hong Kong because the currency is relatively safe. At the same time, Hong Kong’s property market, one of the world’s most expensive, is showing signs of cooling off with borrowing costs likely to rise. Local lenders raised the prime rate, which is often the basis of a cap on mortgages, for the first time in more than a decade in September. Citigroup Inc. and CLSA Ltd. are among those forecasting declines in home prices.

以下是分析人士的看法:

美银美林(Ronald Man,策略师)

香港金管局今年可能需要再支出600亿港元,以维持港元盯住美元的汇率制;这意味着到2019年底,香港的总余额将降至100亿港元,接近2008-09年金融危机爆发前的水平;流动性外流不会导致融资环境变得无序,因为金管局总是可以通过让部分EFBs到期,将流动性释放回总余额;如果存款总额低于100亿港元,优惠利率和存款利率可上调25个基点;港元兑港元汇率在“可预见的未来”接近7.85港元;股票投资者可以用当地美元兑换港币,并通过交易环节购买内地股票;但资金流出香港将是渐进的

花旗集团(Citigroup Inc.) (Sun Lu and Gaurav Garg,策略师)

银行喜欢在短期内用远期做空港元,因为这种交易产生了正的套利,而且低位流动性紧缩的风险很低;与去年同期相比,该行业目前的头寸较轻;这种押注需要“超级杠杆化”,才能挤压出可观的回报;由于美联储的鸽派立场以及香港缺乏有吸引力的科技股首次公开发行(IPO),银行间利率不会大幅上升

星展银行(香港)有限公司(库务及市场部董事总经理Tommy Ong)

一个月和三个月的香港银行同业拆息(Hibor)将攀升,在总余额跌破500亿港元后,将挤压做空港元的空间;这可能在下周末之前发生;隔夜拆息不会持续上升,除非总余额降至200亿港元以下;一个月的Hibor将在3月底达到1.8%,6月底达到2%

大和资本市场(经济学家Kevin Lai)

港元全年将在7.85港元附近徘徊,未来几个月,金管局将多次干预汇市;赖说总余额最终将降至零,但他没有给出具体的时间表;这个过程需要多长时间也取决于美国的货币政策;在流动性池降至零后,Hibor将大幅上升;今年仍有可能大幅加息;今年早些时候,流入香港的外资或多或少已经停止

华侨银行永亨银行(经济学家Carie Li)

港元空头交易的规模没有去年那么大,因为在总余额下降后,投资者变得更加谨慎;总余额可能会在本月跌至600亿港元,4月或5月跌至500亿港元,明年某个时候跌至200亿港元;如果现金池低于200亿港元,香港金管局可能会通过不展期EFBs来注入流动性,以安抚投资者情绪;今年港元兑美元汇率跌至7.83港元以下;在2019年的大部分时间里,一个月和三个月的Hibor将保持在2%以下

海通姜超在2017年一份研报中就曾提到:

中国香港采取的是联系汇率制度,港币紧紧盯住美元:一方面,香港在发行港币时都有美元做“背书”;另一方面,为了保证港币汇率的稳定,金管局设置了7.75 的强方兑换保证和 7.85 的弱方兑换保证。联系汇率制度可以保证港币汇率的稳定,但也导致香港的货币政策完全失去了独立性。在过去的20多年中,美联储每次加息或降息后,香港金管局几乎都会跟随行动,完全失去了货币政策的独立性。

免责声明:自媒体综合提供的内容均源自自媒体,版权归原作者所有,转载请联系原作者并获许可。文章观点仅代表作者本人,不代表新浪立场。若内容涉及投资建议,仅供参考勿作为投资依据。投资有风险,入市需谨慎。

责任编辑:郭建

热门推荐

收起

24小时滚动播报最新的财经资讯和视频,更多粉丝福利扫描二维码关注(sinafinance)