来源:市川新田三丁目

译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Ready for Action?

By Steven Vannelli

Former Fed Governor and now professor at the University of Rochester, Narayana Kocherlakota penned the following short opinion piece in Bloomberg this morning:

曾任明尼阿波利斯联储银行总裁,如今的罗切斯特大学教授Narayana Kocherlakota今早在彭博资讯上刊登了一篇短评:

Fed Shouldn’t Wait to Cut Interest Rates: Narayana Kocherlakota

联储在降息问题上不应动作迟缓

By Narayana Kocherlakota

The world economy is facing a material risk in the form of COVID-19, or coronavirus. Of course, it isn’t clear how much economic damage the virus will do. But it is clear from the damage being done to China’s economy — and the response of other countries to what’s happening in China — that the virus could result in a significant worldwide economic slowdown.

全球经济正面临新冠疫情带来的巨大风险。当然了,尚不清楚疫情会给经济造成多大的损失。但从中国经济目前已遭受到的冲击以及其他国家针对中国做出的反应等方面的情况来看,疫情有可能会在全球范围内导致经济明显放缓。

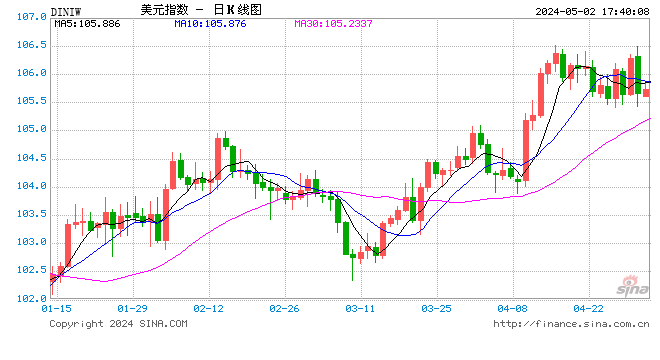

Such a global economic slowdown would likely lead to continued upward pressure on the U.S. dollar, which would drive inflation even further below the Federal Reserve’s 2% target in the next couple of years. And a broad slowdown in the world economy would lead to lower U.S. employment growth, as American businesses endure reduced demand for their goods and services.

如此这般的全球经济放缓将有可能给美元汇率带来持续升值的压力,并在未来几年里将美国的通胀率向下进一步推离美联储2%的目标值。全球经济的普遍放缓会导致美国就业增速放缓,美国商界也会遇到市场对其产品和服务的需求降低的问题。

My benchmark forecast is that the U.S. economy will remain resilient to these forces. But there is a substantial risk that such a forecast could be wrong. One possible strategy is to wait until there actually is a slide in the economy before easing interest rates. But rates are still only a little above zero and so the Fed has few tools available to offset adverse shocks. In this situation, a basic precept of monetary policy is to keep the economy as healthy as possible in advance of downturns. As New York Federal Reserve Bank President John Williams explained in a speech last year, that means cutting interest rates in a pre-emptive fashion when threats to growth become more pronounced. Of course, it was exactly in response to the increase in global downside risks that the Fed cut interest rates by 75 basis points, or three-quarters of a percentage point, in 2019.The Fed’s rate-setting Federal Open Market Committee holds its next meeting on March 17-18.

我的基本看法是,面对这些不利因素美国经济仍将展现出很强的适应能力,但该预测结果失误的概率还是相当大的。美联储可以先采取耐心等待的应对策略,直到美国经济确实出现衰退的迹象后再决策降息。但当前美国政策性利率的水平仅略高于零,因此联储在消除疫情给经济带来的冲击方面几乎没啥应对选项。在此情况下,货币政策的一个基本职能就是确保在经济下滑之前尽可能保持经济的平稳运行。正如纽约联储总裁John Williams 在去年一篇讲话中所揭示的,在经济下行风险变得非常明显之前有必要采取“先发制人”式的降息。当然,这样做完全是为应对全球经济下行风险的上升,而正是这一风险促使联储在2019年降息75个基本点,美联储用于决定利率水平的联邦公开市场委员会将于3月17-18日举行下一次的例会。

I don’t think that the FOMC should wait that long to deal with this clear and pressing danger. I would urge an immediate cut of at least 25 basis points and arguably 50 basis points. That’s a cheap insurance policy for the economy that the Fed shouldn’t pass up.

我认为联邦公开市场委员没必要等上很久以待局势明朗化以及危机变得迫在眉睫,我建议应立即降息至少25个基点甚至是50个基点,联储不应错过这个代价不高即可拯救美国经济的机会。

Fed funds futures are on the move today, with longer dated futures now pricing in now two 25bps rate cuts by the end of the year. However, the market does not seem to be pricing in, yet, any material chance that the Fed cuts at its March meeting.

今天联邦基金利率期货的报价发生了大幅波动,远交割月份的期货合约的最新报价显示市场预测年底前将有两次降息,每次的降息幅度均为25个基本点,但市场报价似乎并没有明确体现出联储在三月份的例会上降息的可能性。

Looking at fed funds futures each quarter of 2020 in yield terms, we can see what the market is discounting this year from the Fed. Effective fed funds are currently trading at 1.58%, so a 25bps cut would take that down to 1.33%. This would suggest the market is assigning a very high probability that we get the first cut by June.

看一下通过2020年各季度最后一个月份交割的联邦基金利率期货的报价推算出的联邦基金利率的水平,从中可以看到市场如何预测联储今年的行动。联邦基金利率的实际利率的最新报价为 1.58%,故降息25个基点意味着实际利率的水平将下行至1.33%,这明市场认为6月份见到今年第一次降息的概率非常高。

If we look out over the next year, comparing the 12th fed funds future to the 1st, we can see the market is pricing in 2.37 cuts over the next year.

再看看明年的情况,将2021年12月交割的联邦基金利率期货合约的报价与2021年1月进行对比,可以看到市场预测明年的降息次数将达2.37次。

This translates into 59bps of cumulative easing over the next year.

2.37次的降息相当于明年累计降息的幅度将为59个基本点。

While the above charts do not yet suggest a market that is forcing the Fed’s hand imminently, things can change quickly. It was only last May that the market forced the Fed’s hand by sending fed funds futures contracts higher. Of course, the backdrop of that episode was a 5%+ stock market correction. If today’s equity market decline continues, the Fed should get ready for action.

虽然上面几张图并不意味着市场正在逼迫联储立即降息,但形势要变还不快吗。以去年5月份为例,在联邦基金利率期货的报价被大幅推高后联储就范了。当然,这一幕出现的背景是美股当时出现了幅度为5%以上的回调。如果美国股市今天大跌的势头持续下去,联储也应做好降息的准备。

免责声明:自媒体综合提供的内容均源自自媒体,版权归原作者所有,转载请联系原作者并获许可。文章观点仅代表作者本人,不代表新浪立场。若内容涉及投资建议,仅供参考勿作为投资依据。投资有风险,入市需谨慎。

责任编辑:郭建

热门推荐

收起

24小时滚动播报最新的财经资讯和视频,更多粉丝福利扫描二维码关注(sinafinance)